This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. For an explanation of our Advertising Policy, visit this page.

Editor’s note: This is a recurring post, regularly updated with new information and offers.

Here’s everything that you need to know about these changes along with how to use Pay Yourself Back.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter.

IN THIS POST

- What is Pay Yourself Back?

- What purchases are eligible for Pay Yourself Back?

- Requesting a credit

- Statement credit options on other purchases

- Bottom line

What is Pay Yourself Back?

In 2020, Chase introduced Pay Yourself Back as an ongoing redemption option within Ultimate Rewards to give cardmembers another choice in how they can redeem points. The categories have evolved over time, with the removal of options such as grocery and home improvement stores.

In short, the Pay Yourself Back option allows cardholders of many Chase cards to use points at a redemption value similar to booking travel. This won’t lead to maximum value for your Ultimate Rewards points, but if you’re looking for a simple return (or are sitting on a pile of points with no immediate use for them), it could be a good choice.

Related: The best Chase credit cards of April 2022

What purchases are eligible for Pay Yourself Back?

All Sapphire Preferred, Ink and Freedom (includes Chase Freedom Flex and Chase Freedom Unlimited) cardmembers can redeem at 1.25 cents per point for select charities with Pay Yourself Back through Dec. 31, 2022. Sapphire Reserve cardmembers can redeem at 1.5 cents per point.

As noted above, there are two new options that directly support humanitarian efforts in Ukraine (International Rescue Committee, Inc. and UNICEF USA). The existing list of charities for Pay Yourself Back remains and includes:

- American Red Cross.

- Equal Justice Initiative.

- Feeding America.

- Habitat for Humanity.

- International Medical Corps (also aiding efforts in Ukraine).

- Leadership Conference Education Fund.

- NAACP Legal Defense and Education Fund.

- National Urban League.

- Thurgood Marshall College Fund.

- United Negro College Fund.

- United Way.

- World Central Kitchen (also aiding efforts in Ukraine).

In addition to charitable donations, there are a number of other popular categories that participate in Pay Yourself Back. Here are the additional options currently in effect:

| Card | Redemption value | Categories | Current end date |

| Chase Sapphire Preferred Card | 1.25 cent per point. | Airbnb. | June 30, 2022. |

| Chase Sapphire Reserve | 1.5 cents per point. | Airbnb and dining at restaurants (including takeout and eligible delivery services). | June 30, 2022. |

The information for the Chase Ink Plus card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Let’s say you had an eligible purchase on the Chase Sapphire Reserve. Instead of $100 when redeeming 10,000 points, if redeeming against an eligible Pay Yourself Back charge, a Chase Sapphire Reserve customer would receive a credit of $150 for the same redemption amount. This is the same redemption rate offered on Ultimate Rewards Travel redemptions for that card.

Requesting a credit

The process of requesting a credit through Chase’s Pay Yourself Back program is relatively straightforward. Simply log into your relevant Ultimate Rewards account via mobile app or desktop and select the “Pay Yourself Back” option in the sidebar.

The Best Travel Bag for Your Next Trip: How to Choose the Right One tThe Best Travel Bag for Your Next Trip: How to Choose the Right One

qwer sdfjsdijfo djsofsdofjosdjfoisjdfo jsdofjosdjfoisdjfoi jsdofjoisdhfobsda bflskadbfksdabf jkbsadjkf bskadbfkjsd bflkasdblfbsk dalfblksadbf kbsadlkfbsakdfbkas dbflkasdblkfbs adjkbflsakdbflksadb flksbdaflkjbsadl kfjbsadklbflksj adbfklsadbflkj asdbflkasdb kl bsldakbfksaldbfkl sbfdk lbasdlkfba sdklfbj kasdjbf klsdabfkljs bdkflbsa kldjbflksa dbfklasdb fklsbdafklsb dflkbsadl fbasdlkfb askd lbflsadb flkbsad wfhowehi fowhe2342 9012509 8012957091275 01275871298 712950 7910257 90125912750917259 dsfsdfsdf

This group changed my life. My credit has risen 170 points in the last year from joining these guys. The new vacation section is crazy too. I got a king suite in Orlando $250 less than any other app. They helped changed my financial perspective which in turn made my personal time much nicer spent.

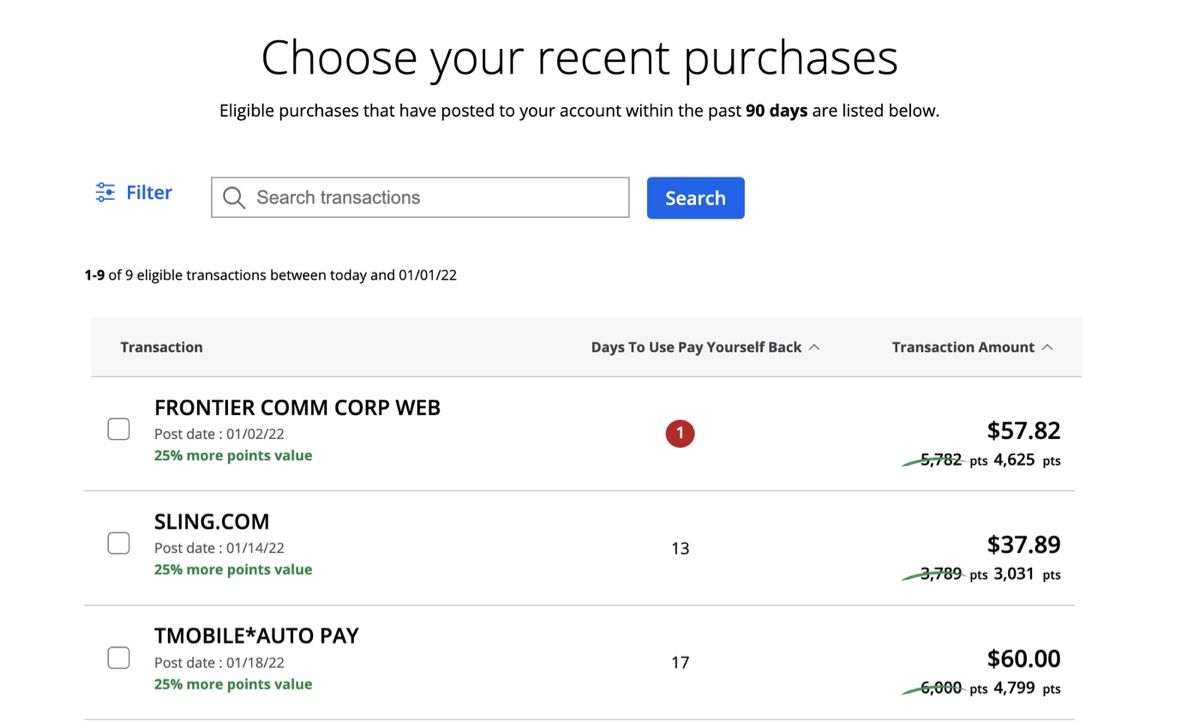

Next, you’ll see a list of eligible purchases you can redeem points for. Points can be redeemed for purchases as far back as 90 days, at a rate of 1.5 cents each for Sapphire Reserve cardholders, 1.25 cents if you have the Sapphire Preferred, Ink Business Preferred or Ink Plus and 1.1 for the Ink Business Cash and Ink Business Unlimited. The example below is based on redemption rates for my Ink Plus.

I had nine eligible internet, cable and phone purchases (three shown) on my Ink Plus in the last 90 days. Simply check off the purchases you want to redeem and proceed to the next page.

American Express Platinum Card

Experienced Users

Intro offer

100,000 Points

Annual Fee

$695.00

Recommended Credit

100,000 Points

You can choose to offset the full purchase amount, assuming you have enough points to cover it, or you can redeem a smaller amount if you prefer.

From there, you can confirm the redemption value and amount and choose to complete the transaction. Your statement credit should post within three business days.

Statement credit options on other purchases

Chase has long offered the option to redeem points for a statement credit — that’s not new. Simply log into your Ultimate Rewards account, hit the drop-down menu and select “Cash Back.”

You’ll be presented with an option to enter the amount you’d like to redeem and where you’d like your rewards deposited. All cash-back redemptions are fixed at 1 cent per point, only half of TPG’s valuation for Ultimate Rewards.

Apple Card

Best for Apple users

Intro offer

0

Annual Fee

$0.00

Recommended Credit

0

Even so, Chase’s traditional cash-back option is more generous than what you can expect from some other issuers. Here’s how it breaks down for some of the most popular programs and cards:

| Program | Redemption value | Cards |

| Amex Membership Rewards | 0.6 cents per point. | American Express® Gold Card, The Platinum Card® from American Express. |

The information for the Citi Prestige card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Chase’s Pay Yourself Back feature provides valuable flexibility for many cardholders. But does it make sense to redeem Chase Ultimate Rewards points at up to 1.5 cents apiece toward non-travel charges, which is still at least 25% shy of TPG’s 2-cent valuation?

Ultimately, that decision comes down to how you plan to use your points, how many you currently have with airline and hotel programs, and whether or not you’d benefit significantly from the statement credits.

This group changed my life. My credit has risen 170 points in the last year from joining these guys. The new vacation section is crazy too. I got a king suite in Orlando $250 less than any other app. They helped changed my financial perspective which in turn made my personal time much nicer spent.